costa rica taxes pay

Past the deadline and just pay a small interest penalty. This means you dont have to pay taxes in Costa Rica for any income you made from outside of the.

Property Taxes In Costa Rica Plus Luxury Home Tax And Corporation Tax Osa Tropical Properties

The capital gains charge is 15 for residential properties and 30 for commercial properties.

. Income tax rates for both companies and individuals are calculated on a progressive scale depending on gross income. However the law establishes special regulations for small companies whose gross income does not exceed 112170000 Costa. Corporate income is taxed at a 30 rate.

Tax in Costa Rica uses a territorial taxation system. The annual property tax in Costa Rica is assessed at a fixed rate of 025 of the propertys value per year. According to Law 7509 Ley Sobre Impuestos de Bienes Inmuebles the annual property tax that is required to be paid is 025 of the assessed value which is.

The central American country Costa Rica has introduced a bill in the countrys legislation to regulate cryptocurrency such as bitcoin in the country. A resident for tax purposes is anyone who spends more than. In case of legal entities income tax ranges.

For properties with values above CRC 137 million 2022 you will also have to pay a luxury tax of. Income taxes on individuals in Costa Rica are levied on local income irrespective of nationality and resident status. Costa Rica didnt have a capital gains tax except for developers until 2019.

When property is purchased in Costa Rica it. Lawmakers in Costa Rica are working to make the Central American country a Bitcoin-friendly nation with significantly lower taxes on crypto. The bill in the legislation.

Costa Rican income tax is payable on any income that is generated in Costa Rica for residents or non-residents. You only pay income tax if earn an income in Costa Rica. In Costa Rica you might actually have to pay luxury task on your property.

If you are investing in real estate in Costa Rica you will pay annual property tax of 025. The ordinary fiscal period of the. This week Costa Rican.

However it is a tax obligation and it would be prudent to pay the tax you can pay the Costa Rica corporation tax later ie. Last reviewed - 03 February 2022. Now this tax applies to houses condos and apartments whose value of construction was beyond the.

Yes retirees in Costa Rica do NOT pay any taxes on their foreign retirement income.

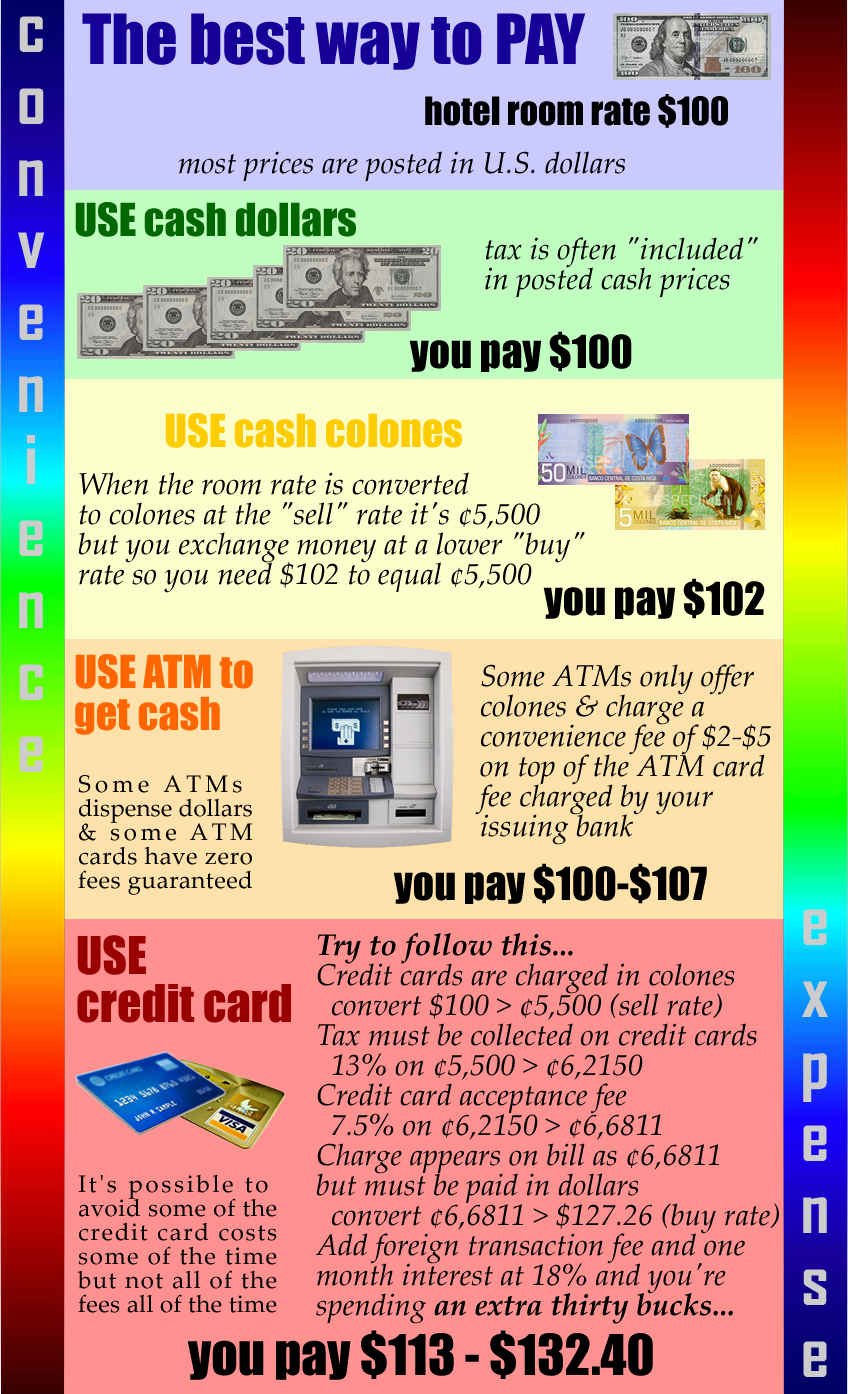

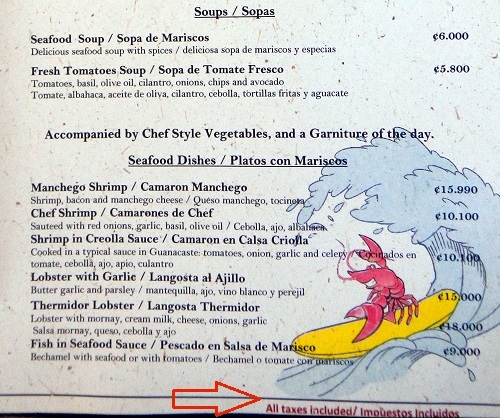

Money Getting It Carrying It And Spending It In Costa Rica

Avoid Paying The Yearly Corporation Tax With A Civil Company In Costa Rica Costa Rica Star News

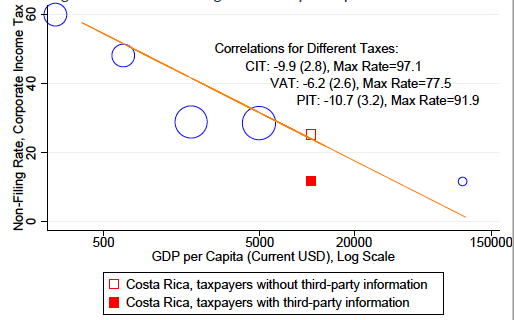

How To Cast A Wider Tax Net Experimental Evidence From Costa Rica Voxdev

International Taxes In Costa Rica What You Need To Know

Why Are Costa Ricans Not Willing To Pay Taxes Q Costa Rica

Costa Rica Sales Tax Rate Vat 2022 Data 2023 Forecast 2006 2021 Historical

Tipping In Costa Rica Easy To Follow Costa Rica Tipping Guide

All About The Taxes Of Costa Rica Special Places Of Costa Rica

Property Tax In Costa Rica When To Pay Luxury Tax Too Youtube

Costa Rica Corporation Tax How Much Are Corporate Taxes In Costa Rica Costa Rica Connection Blog

10 Tax Tips For U S Citizens Living In Costa Rica In 2021

Capital Gains Tax Costa Rica Costa Rica Real Estate

Costa Rica Chat April 2022 Expats Corporations Taxes Costa Rica Matt Youtube

How To Save Money With Municipality Taxes In Costa Rica Costa Rica Star News

Costa Rica Business Environment Taxes

What Taxes Would I Pay Living In Costa Rica Youtube

Who Pays Taxes In Costa Rica Real Estate Blog

New Taxes And Obligations In Costa Rica Know Before You Invest